The Essential Insights of a Marketplace

What We’re Seeing in LatAm Marketplaces

Latin America’s e-commerce landscape continues to expand at pace, with online spending already representing 52% of total purchases in 2024, and projected to reach 63% within the next five years. Marketplaces lead the digital shopping mix, capturing 26% of total shopper spend in the region (VML).

Why are marketplaces pulling ahead? We see three powerful drivers at play:

Convenience: A one-stop shop experience is winning hearts.

Attractive benefits: From installment payments to free shipping and loyalty rewards, marketplaces offer consumers a compelling deal.

Discovery: A wide assortment and competitive pricing are fueling exploration and trial.

However, building a marketplace in Latin America comes with its own unique set of challenges, distinct from those found in the U.S. or other regions.

FV’s PortCo CEO: “In the U.S., you can plug into an existing infrastructure of payment providers and logistics networks, which lets you focus on building the technology layer. In Latin America, you often have to build that infrastructure yourself.”

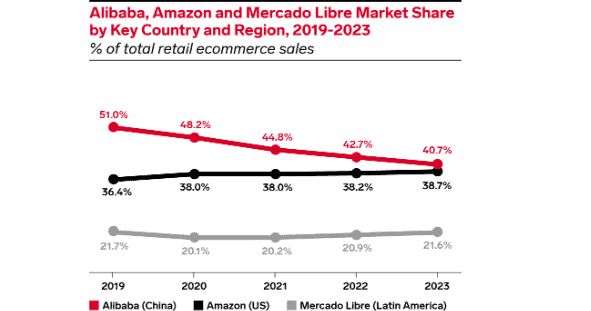

This is primarily due to the lack of existing structure and the informal nature of the market. This informality affects everything from commerce and the standardization of payment processes to supplier registration. The region's fragmented landscape is also reflected in the competitive dynamics. Unlike the U.S. or China, Latin America lacks a single dominant player. According to eMarketer, Mercado Libre, the incumbent, holds only 22% of the e-commerce market. That’s far below Amazon’s 39% share in the U.S.

Insider Intelligence Forecasts - June 3, 2022

Because of this decentralized structure, sellers are being forced to adopt multi-platform strategies, spanning players like Magalu, Via Varejo, Amazon, and Coppel. We believe this fragmentation is a defining trait of the region and a catalyst for multi-channel innovation.

How Marketplaces Work

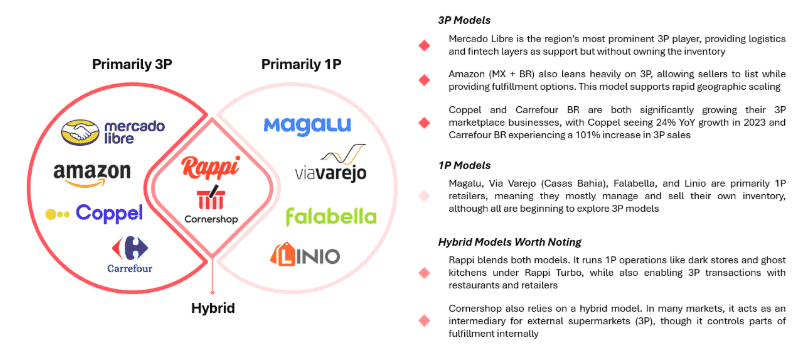

We typically see LatAm marketplaces operate through a hybrid of:

3P (third-party) models, where sellers list and sell directly on the platform

1P (first-party) models, where the platform buys inventory and resells it to consumers

While both models coexist, we’re observing strong momentum toward 3P. It’s asset-light, more scalable, and particularly effective for onboarding small and medium-sized sellers. For many platforms, 3P has become the growth engine.

Here’s how major players stack up by model:

We believe the shift toward 3P is not just a trend but a structural evolution. Consider the traction:

Carrefour Brazil saw its 3P GMV grow 101% YoY between 2021 and 2022

Mercado Libre Mexico achieved 23% 3P volume growth without holding any inventory

Coppel expanded its 3P share significantly in just one year

This momentum is not unique to LatAm. Globally, 3P eCommerce is forecast to grow at an annual rate of 11.7% from 2023 to 2028, nearly double the pace of 1P eCommerce at 6.6% (Flywheel). The continued rise of 3P is being driven by marketplace expansion and the economic advantages of seller-driven assortments, underscoring that the structural shift seen in LATAM reflects a broader, worldwide transformation.

How to Measure Success in Marketplaces

GMV - Why is it Important?

While Gross Merchandise Value (GMV) is the go-to metric for marketplaces, it can be pretty misleading on its own. GMV can grow in two ways: either you bring in new customers, or your existing customers spend more.

But here's the crucial part: true product-market fit isn't just about initial sales; it's about what actually sticks. That's where GMV retention comes in. This metric specifically measures the latter growth driver, how much your same clients are increasing their spending over time. In essence, it tells you if your platform is building a loyal, growing customer base, not just attracting one-time buyers.

Think of it this way: If a cohort of sellers generates $10k in GMV in January and $7.5k in February, M1 GMV retention is 75%.

According to a16z, best-in-class consumer marketplaces can keep supply-side GMV, the sales generated by their sellers, at or above 100% through month 12 and beyond, because the sellers who stick around often grow their sales 2-3x+. The average marketplace is lower, holding 80-95% in the first three months before settling around 45-50% by month 12. On the demand side, the purchases made by buyers, retention starts around 66% in month 1 and declines from there.

So, let's revisit those two ways GMV can grow. While new customers certainly come from effective acquisition strategies, assuming you're not churning a worrying number of them after their initial purchase, the true secret lies elsewhere. It's all about retaining those customers and getting them to spend more over time. That's where sustainable growth really comes from. To keep customers coming back, marketplaces have discovered a powerful hook: financial products. We'll dive into that in the next section.

PMF + Distribution: the Secret Sauce

FV’s PortCo CEO: “I'd hold off on going to the next country. You need to find PMF before expanding. We need to maintain a demanding pace that still helps us gather key insights.”

PMF and distribution are two pillars for a marketplace to succeed. Product-market fit (PMF) is about creating a two-sided network where a product satisfies a strong market need, while distribution is how you attract and grow that network. You can't have one without the other, as they're interdependent: PMF validates demand, and distribution enables you to grow the supply and demand sides of the market.

For a marketplace, PMF means finding a strong need that can be fulfilled by both sides of the market. It's not just about a product; it's about a network effect where the value of the platform increases as more people or businesses join. For example, the more drivers join Uber, the faster a ride can be found, which in turn attracts more riders.

FV’s PortCo CEO: “You need to be cautious when experimenting.”

Finding PMF requires a disciplined approach. Without it, a marketplace is a "ghost town", it might have a well-designed platform, but if no one is using it, there's no business.

Distribution is the strategy for acquiring both the supply (sellers) and demand (buyers) sides of the marketplace. This is a crucial challenge because it's a "chicken-and-egg" problem: you can't attract one side without the other. Effective distribution solves this by focusing on one side first, often the one that's harder to acquire. A well-executed distribution strategy ensures that the marketplace has a healthy balance of supply and demand, allowing it to scale effectively. Without a clear plan for distribution, even a product with great PMF will fail to gain traction.

Embedded Finance: a Strategic Move for Marketplaces

Flywheel Effect: Financial Products Boost Retention

Credit, loyalty, and embedded payments do more than monetize. They reinforce behavior and create long-term engagement.

For buyers, solutions like BNPL and digital credit cards increase conversion and average order value. For sellers, working capital loans, inventory financing, and early payouts help them grow and perform better.

RappiCard, backed by Banorte, provides instant approval and 30-minute delivery of physical cards in eligible zones. On the merchant side, players like R2 and Credijusto enable platforms like Rappi and Uber Eats to offer pre-approved loans based on live sales data.

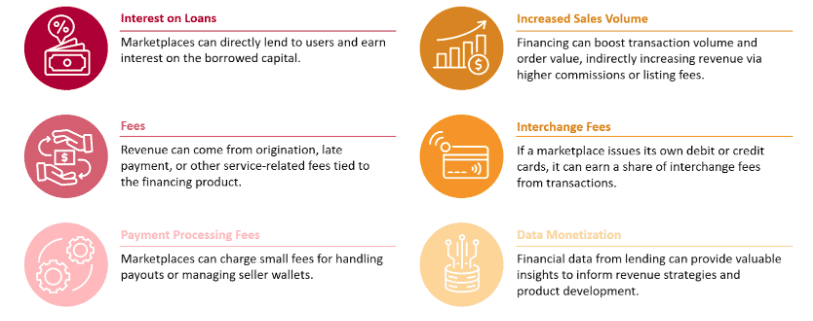

Retention is the obvious driver here, but these financial offerings bring a whole lot of other benefits to the table. Embedded finance also increases the average transaction value, making it much easier for customers to complete a purchase and ultimately driving a higher volume of transactions.

Data Advantage: They Know Their Users Intimately

Marketplaces sit on rich behavioral data. They know how frequently buyers purchase, how much they spend, how reliably sellers fulfill, and how often items are returned. This data gives them a clear edge in underwriting, allowing them to offer credit to both buyers and sellers.

During the pandemic, 45% of users got their first credit card through Mercado Pago. On the supply side, 80% of merchants received their first loan from the same platform. For many, marketplace credit became their first step into the formal financial system.

Monetization and Competitive Edge

Margins on transactions alone are limited. Credit opens new monetization layers. Especially on the seller side, financial products solve real liquidity pain points while deepening dependence on the platform. These tools are not just features. We believe that for marketplaces, launching financial products is no longer optional. The real differentiation lies in designing credit systems that amplify platform value and user loyalty on both sides.

How Marketplaces Generate Revenue from Financing:

A Big Flaw: Breaking Down the Barrier of Trust

When it comes to offering credit, a significant component is mutual trust. Customers need to feel confident enough to share their financial information with a platform they may not be familiar with. In turn, a business is placing its trust in the customer when it extends credit.

To overcome this dual challenge, platforms must build confidence on both sides.

For the customer: Offering financial products helps break down the initial barrier of trust. As a customer becomes more familiar with the platform and sees that they're not the only one using it, they're more likely to engage with and spend on it.

For the business: By offering credit, a platform is taking a risk, but it's also a powerful way to build loyalty. When a customer receives credit, they are more likely to make a purchase and return to the platform that made it possible. This can be a significant advantage in a competitive market.

Marketplaces Are Gaining the Upper Hand

Marketplaces are evolving beyond simple platforms for buyers and sellers; they are becoming comprehensive digital ecosystems. Their unique strength lies in the extensive transactional data they generate every day. By leveraging this foundation, offering integrated financial services—like payments, credit, and loyalty programs—is no longer optional; it has become a strategic engine to boost retention, strengthen trust, and expand their value proposition.

This shift makes sense. Marketplaces have unique insight into their users' habits and cash flow, allowing them to offer tailored financial products while diversifying revenue. As the line between commerce and banking blurs, marketplaces that successfully combine both will not only secure their position as leaders but also become essential players in the new digital financial landscape.