The Inside Scoop: Our Key Factors in Analyzing Founders to Back

*Important Note: In addition to the attributes discussed in this article, we also consider other variables when investing. This article provides insights into key attributes, but it's important to note that they are not the sole factors influencing our investment decisions.

After five years of founding FEMSA Ventures we have developed distinct criteria for analyzing startups with whom we aim to set up long-term relationships. This journey has led us to create our own framework that guides our decision-making process when analyzing which entrepreneurs to support. Although we consider other variables, we genuinely believe that in the end, we invest in founders. Yes, great products/services with great technology, great markets to conquer, great business models, but in the end, it is about GREAT FOUNDERS.

Bet on People: A Non-Contrarian and a Glimpse into a Contrarian Point of View

Non-contrarian. One of the most basic concepts when investing in early-stage companies is the idea that the founding team is all that matters. The horse and jockey analogy is often used to describe this dynamic where you can either pick to bet on the horse, meaning the business or idea, or on the jockey, meaning the people running the company. In this two-dimensional framework people will often say they are betting on the jockey. Ideas might be replicated but the ability to execute and overcome challenges will only come from a strong, passion-driven, resilient team.

If you think about it. Who is going to say people are not the most important thing? How many times have you heard the phrase: “people are our most important asset”. Is it? When trying to define the probability of a startup being successful, we believe it is not a clean-cut answer. However, before we take the contrarian POV, let’s keep digging on why the team is important. Because at the end of the day, it is.

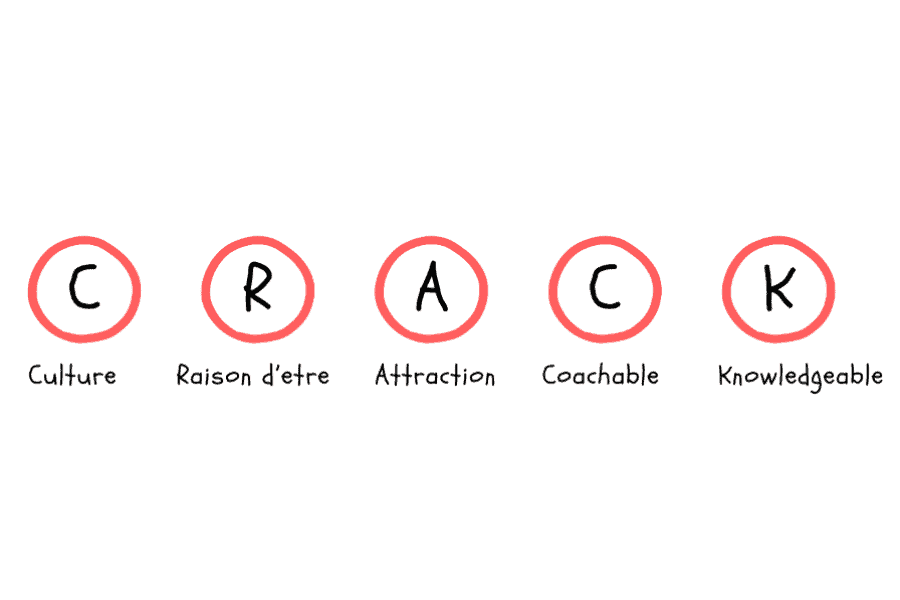

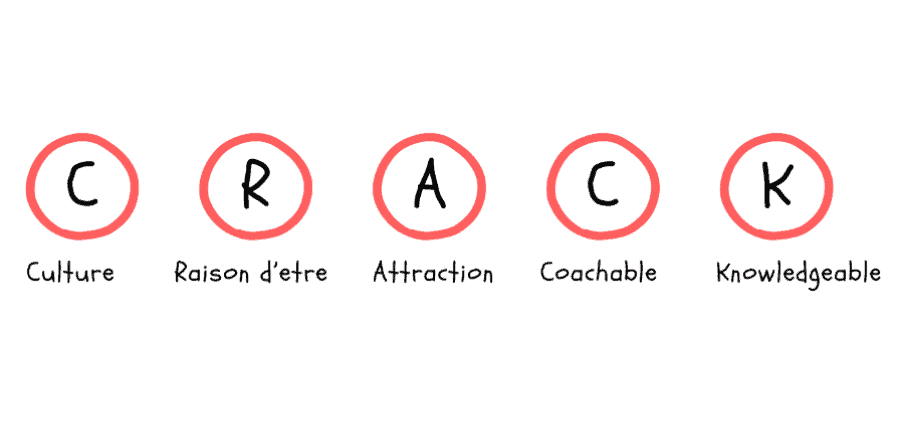

When trying to analyze teams VCs (Venture Capital) have approached the task with creativity. We have heard of investors analyzing teams via personality tests while others just trust their gut in what might look to an outsider as a very fugazzi vibe-test. While both approaches yield answers, our experience has taught us that having a framework to analyze teams comes in handy to rationalize and quantify personality traits and quirks. That is the spirit in which the CRACK framework was created. A letter for each one of the characteristics we believe are important to have on the team while building amazing companies. A qualitative analysis for each one of the letters followed by an effort to quantify the team on a 1-5 scale.

Starting strong. The first C stands for Culture. A team that shares our values and is creating a meritocratic company. We try to spend as much time as possible with the founding team, ideally in different scenarios, before assessing how our team’s cultures will blend.

R. Raison d’etre. A purpose driven founding team with fire in the belly about a topic that matters to them. We have seen it all. The non-uncommon story of a company that was born because someone working at X experienced first-hand a pain point so massive that they decided it was worth it to pursue of a solution, all the way to personal, deep, and emotional connection with a healthcare problem that happened to a family member.

A. Attraction. A two-pronged approach: talent and funding. How good is the founding team in recruiting and managing top talent? Magnetism towards people. Is the founding team capable of inspiring and being assertive of their vision? We invest at the early stage; do we believe this team can fund later?

Second C. Coachable. Not by VCs, but their approach in life. Eagerness to learn. Extremely high self-awareness at a personal level is a must. Nothing is more troublesome than a person who does not know where their true strength lies and what opportunities they are missing. We love founders who have spent time working on themselves. The same applies at a team level, although this characteristic is not usually prioritized.

K. Knowledgeable. Teams that understand the key levers of their business. This doesn’t necessarily mean founding teams who are repeating on the industry but rather founders who have spent time analyzing how different variables affect their company. Both in-house (Unit economics, monetization strategies, P&L, etc.) and towards market dynamics and trends.

A contrarian glimpse. Having said the above. Do we really believe that people are all that matters? Or even the thing that matters the most?

In the product-market-team trifecta, there is a case for each one. Product-centric investors will argue that for amazing products markets can be created, and people will follow. Market-oriented underwriters claim that “a rising tide lifts all boats,” in a blooming sector, product will be pulled in as long as it is viable, regardless of how good the team is.

While certainly the topic for another writing, there is value in analyzing deeper the non-people-oriented views as it provides a fresh perspective into what matters when building companies.

Taking the correct risks, embracing mistakes.

- “We screwed up, but now we know why.” – said a founder at a board meeting a few weeks ago, and we felt a wave of excitement. What came right after was the most valuable discussion we have had in months.

There are many disciplines that use errors, mistakes, deviations, variability and randomness to gather valuable information and derive learnings that are later used and incorporated into systems and solutions to improve future outcomes. The good old “trial and error” approach to finding solutions has produced incredible advancements in virtually every field of human development. We have all heard or read romantic stories about serendipitous discoveries like Penicillin or 3M’s PostIt® glue that have happened around a glorious mistake.

Being close to mistakes, and more importantly, having the ability to recognize and distill learnings from failures, is a sought-after trait that we as VC investors are constantly looking for in founders. During our due diligence conversations, we pay particular attention to how founders speak about their mistakes, and how often they touch on topics that are still not fully understood. If you are reading this, and you are a founder that is interested in working with us, here is an unrequested tip for you: share with pride what risks and mistakes you have made and how those were helpful to you in finding better answers. Also, you will get extra points in our grade sheet if you say the dreaded phrase “I don’t know” more than once.

“Every plane crash brings us closer to safety, improves the system, and makes the next flight safer” -N.N. Taleb, Antifragile, 2012.

Not all systems are set in ways that benefit from mistakes. The tremendous learning potential that mistakes represent can only be harnessed if they are followed by an honest “post-mortem” analysis with painful candor. Reflecting on the sequence of events, the choices made, and the interdependencies of every action is very helpful to understanding how deviations become inevitable, and more importantly, what solutions are available to both prevent them from happening and correcting them after they happen. Our founder had to look at what happened and reflect on what choices and actions led to the undesired outcome before falling for the temptation to fix it. This team had overinvested in one particular function and underinvested in a different one, without considering the fact that both functions were interdependent.

In his book, Taleb goes on to illustrate how there are examples of systems where mistakes produce the opposite effect, like the idea that every financial crisis makes the next one more likely. Mistakes that produce contagion are the ones to avoid.

In VC we are exposed to, and often take for granted, a disproportionately large universe of teachable mistakes. We are a risk-seeking industry that creates value precisely by de-risking assets and business models that are typically in the frontier of the risk-reward curve. The only other important lever at the top of the value creation ranking is accelerated growth. Startups are more valuable as they grow fast, and as they are less risky than before.

We like to think of VC investors as founder helpers that not only bring in financial resources that are necessary to give ideas a working chance, but also, and more importantly, provide the proper spaces for discussions and analyses that hopefully help founders and their teams to grow to love their mistakes and learn from them consistently. These discussions only work when there is a product that adds the correct value and priority to its client, with a founder that ranks high on our “Coachable” criterion and that, most likely, loves mistakes as much as we do.