The “Missing Middle” in Spanish-Speaking LatAm VC

There’s plenty of capital in Latin America’s startup ecosystem, but is it showing up where it’s actually needed? FEMSA Ventures mapped the VC landscape across Spanish-speaking LatAm, focusing on funds that align with our investment thesis. While not exhaustive, the mapping offers a directional view of capital dynamics across the region, excluding niche vehicles like fintech-only or secondary funds. What we found? A clear gap in the availability of mid-sized funds.

The Capital Gap: Where Are LatAm’s $20–50M Funds?

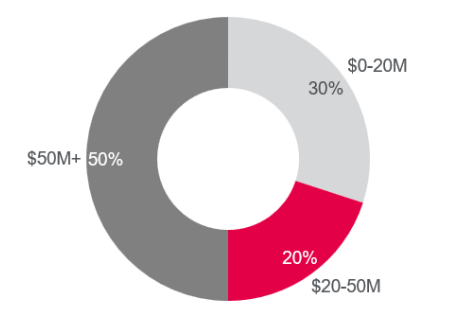

Capital in LatAm’s VC ecosystem is heavily concentrated at both ends of the spectrum. Roughly ~50% of funds manage over $50M, and another ~30% manage under $20M. Only ~20% of funds fall in the $20-50M range, leaving a clear gap in the market.

While ~40% of early-stage funds in LatAm in 2025 fell between $10M-$50M, most cluster near the lower end of that range. The median pre-seed fund is $10M and the median seed fund is $15M, suggesting that very few vehicles reach the scale needed to actively lead or follow-on in more competitive rounds.

In Mexico specifically, the median fund size is just $10.5M, reinforcing the limited availability of capital beyond the very early stage in key markets.

This mid-sized segment is particularly relevant for backing companies between Seed and early Series A, where capital needs start to grow, but institutional investors remain selective or absent. The lack of competition creates a favorable entry point for funds that can move with conviction and discipline at this stage.

Agile, Aligned, and Outperforming: The Case for Right-Sized VC

Funds in the $20–50M range, offer a strong balance of return potential and portfolio manageability. They tend to outperform larger funds on a TVPI basis, while offering more consistent results than the very smallest funds. In early-stage LatAm, that balance matters. These vehicles have enough capital to build meaningful ownership and follow-on, without requiring billion-dollar exits to deliver strong returns.

The return math favors right-sized funds. A $20-50M vehicle can achieve strong multiples with a handful of solid outcomes. A $500M+fund needs multiple billion-dollar exits to get there, which is a much taller order in this ecosystem.

Large funds tend to favor consistency and capital preservation. Right-sized funds, on the other hand, can be more agile, selective, and aligned with early-stage dynamics, backing companies when the slope of value creation is steepest.

We believe the $20-50M range is well suited for the current stage of LatAm ventures. It offers enough flexibility to lead or follow-on in breakout deals, without requiring unicorn-level outcomes to deliver compelling returns.

As institutional capital increasingly turns its attention to Latin America, mid-sized funds, though currently underrepresented, offer characteristics well aligned with the region’s early-stage investing landscape. With enough capital to build meaningful ownership and follow-on capacity, and a scale that doesn’t rely on unicorns, these vehicles may become a key part of the region’s evolving venture landscape.